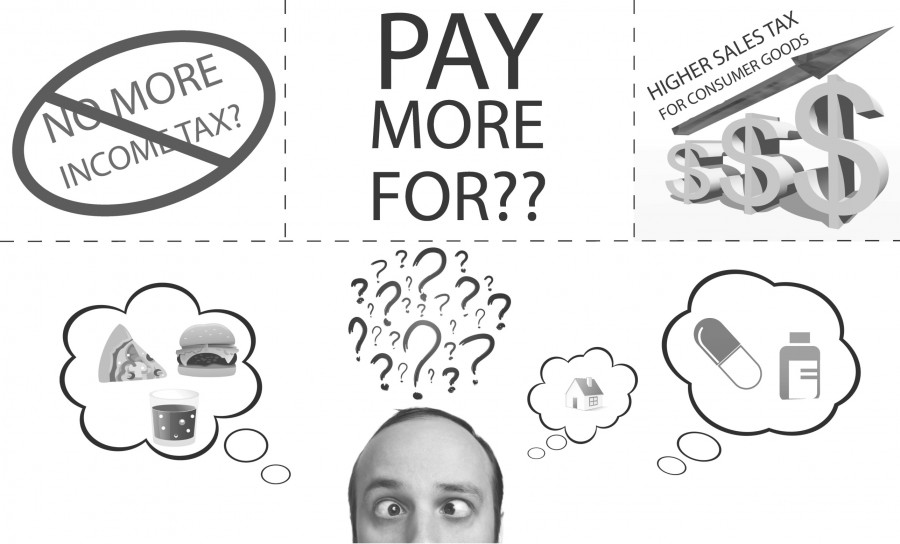

The elimination of corporate and individual income taxes are part of Gov. Bobby Jindal’s new tax proposal that would also increase the state’s sales tax to make up for the loss in funds.

Jindal said the reforms will help Louisiana families save money and also make the state attractive to businesses.

“Eliminating personal income taxes will put more money back into the pockets of Louisiana families and will change a complex tax code into a more simple system that will make Louisiana more attractive to companies who want to invest here and create jobs,” Jindal said in a press release.

The bold tax reform will be advocated at this year’s legislative session. The overall idea of his plan is to help develop economic growth by eliminating the corporate and individual income tax in an effort to attract more businesses to the state.

John LaJaunie, professor of finance and economics, said the outcome of the proposed tax reform is debatable based on details of what can and cannot be taxed.

“Sales tax has a problem with it that it tends to be volatile,” LaJaunie said. “Consumers do not buy as much, particularly big ticket items, which would generate dollars of sales tax revenue when the economy is sluggish.”

Morris Coates, professor of finance and economics, said the success of the tax reform depends on the structure and implementation by the Jindal Administration.

“Depending on how the sales tax is structured, it can be harder on those with lower income than those with higher income,” Coates said. “Sales tax grows with the economy, but income tax grows with the economy even more.”

He added the tax reform could be positive since it would raise awareness to how much the government is costing taxpayers.

“If implemented right, it can be a decent policy change, because for the most part, a lot of people don’t see how much the federal or state government is taking out of their check,” Coates said. “By increasing the sales tax, it will help to make people more aware of how much the government is costing them.”

Although the plan seems positive for economic growth, Coates and LaJaunie agreed that a gradual implementation would yield more beneficial results.

The tax reform would affect students enrolled in higher education in the state since the higher education budget would be one of the first affected if the plan does not work. Coates said with a sudden shift to eliminate income tax, the state would not be able to make any adjustments to fix problems that may arise if the plan does not work.

However, with a slow and deliberate adjustment toward lower income taxes and higher sales taxes, the state could avoid “having the bottom fall out of the state budget.”

“Before the rest of the state’s budget could be adjusted, it would wipe out health and hospital spending and higher education spending because of the state’s constitution,” Coates said. “So much of the state budget is protected so it would all fall on healthcare and higher education.”

State Representative Jerome “Dee” Richard said the legislature having students pay more tuition is not the answer if the tax plan does not work.

“I believe higher education is better funded by the State, which I think we do a poor job at,” Richard said. “We’re cutting the budgets and having you and your parents pay more tuition. It’s not fair.”

According to Tax Foundation, corporate and individual income taxes are two of the most destructive taxes that hinder economic growth, and analyst Scott Drenkard said the plan is a step in the right direction to build Louisiana’s economy.

With the release of information about the tax plan so far, Tax Foundation calculated that the new proposals would move Louisiana’s business climate from 32nd to fourth overall on its State Business Tax Climate Index.

The Heartland Institute reported several states such as Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming have eliminated or lowered their income tax in order to spur economic growth. For Louisiana, it would attract more businesses since the state has one of the most complex states codes, which creates high compliance costs for businesses and individuals.

Although the tax reform plan can be justified by the successes of other states, LaJaunie said other states that have eliminated their income taxes also have other taxes in place that provide stability.

“Other states like Texas who use a sales tax and have no income tax have a rather onerous property tax base that provides stability for revenue,” LaJaunie said. “It seems good for other states because those states are supporting it with the property tax, which is stable.”

“Somebody has got to pay the bill and people who purchase goods and services are the one who will have to pay the bill,” LaJaunie said.

More details about Jindal’s tax reform plan will be made available closer to the start of the legislative session on April 8.