Talk among graduating seniors includes applications, job interviews, graduation trips and the heaping amount of debt that goes along with the celebration of the end of a chapter.

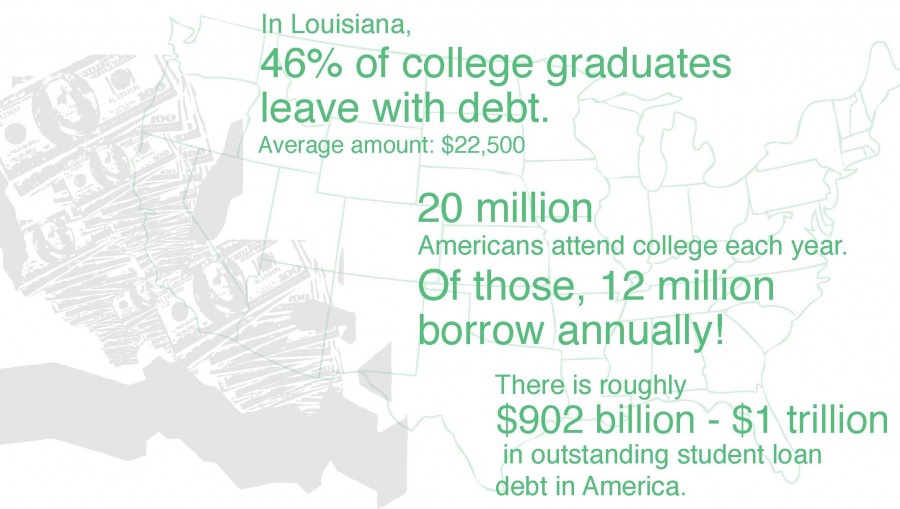

According to CNN Money, in the state of Louisiana, 46 percent of 2011 graduates had debt in college and the average total they owed was $22,500.

American Student Assistance states that 20 million Americans attend college each year and of those 20 million, about 12 million borrow annually to help cover costs. There is roughly between $902 billion and $1 trillion in total outstanding student loan debt in the United States today.

One factor of student debt is the rising cost of tuition.

The University of Louisiana System consists of nine universities in Louisiana, which includes Nicholls.The UL system approved a 10 percent tuition increase for these universities for the 2013-2014 school year.

“No one wants to raise the price for our students, but it is an unfortunate necessity at this time. Our universities are cognizant of the need to offset these rising costs in the form of additional financial aid and scholarships,” Sandra Woodley, UL System president, said in a board-issued newsletter.

The 10 percent increase will bring Nicholls tuition from $2,755.60 per semester to $3,031 per semester. However, for students with TOPS, this increase does not bring much of a burden, since the TOPS program covers it. For students who do not have TOPS, this increase can take a toll.

On top of the rising tuition that students will see in the 2013-2014 school year, there will also be an increase in student assessed fees due to the passage of a referendum this semester.

“The first thing that pops into my head is ‘ball and chain,'” Cydney Soignet, marketing freshman from Cut Off, said about the additional money she will have to pay. “Education should be one of the smartest investments a person makes, but with today’s economy, the return on investment is iffy and that is definitely something to be scared of.”

Shari Lawrence, associate professor of finance, and Paul A. Callais Endowed Professorship in Business recipient, said, “Students should view their education as an investment, but students should be sure that the degree they are obtaining offers them a chance to get a job that has the income to justify the amount of debt they are taking on.”

Students who are starting to apply and accept financial aid have a variety of types to choose from. These types fall into four categories: grants, loans, federal work-study, and scholarships.

Students who qualify can apply for four different types of grants.

There are Federal Pell Grants, which are awarded to undergraduate students that have no previous degree, and they must meet the satisfactory academic progress standards. Along with the criteria, the eligibility is determined by the student’s expected family contributions and cost of attendance.

Students with exceptional need and have the lowest expected family contribution and are also receiving a Federal Pell Grant may also be eligible for the Federal Supplemental Educational Opportunity Grant.

The Louisiana Go Grant is a need based state grant for students. This grant is aimed at bridging the gap between the amount of financial aid a student is awarded through the Federal Grant program and the actual cost of attendance.

The last grant is the Teacher Education Assistance for College and Higher Education (TEACH) grant. This grant is for graduate and undergraduate students who intend to teach full-time in high-need subject areas for at least four years at schools that serve students from low-income families.

There are four types of loans available as financial aid: subsidized Stafford loans, Unsubsidized Stafford loans, Parent Plus loans, and Private loans.

Stafford loans are awarded to undergraduate students on the basis of need from the Free Application for Federal Student Aid (FAFSA). The government pays the interest on the Stafford loan while the students are enrolled in school.

Unsubsidized Stafford loans are not distributed based on need, and the government does not pay the interest while students are enrolled in school. The interest is charged from the time of disbursement until the loan is paid in full. Similar to the Stafford loan, repayment of this loan will begin six months after graduation or from the time the student drops out of school, or drops below part-time.

Parent Plus loans are for parents who help pay for the cost of their students’ education. Parents have to pass a credit check, either on their own or with a co-signer to be eligible for the funds. Both parents and students must meet general eligibility requirements for federal financial assistance.

Private loans are loans dispersed based on the credit history and usually have higher interest rates.

The Federal Work-Student program is federally funded financial aid that enables students to earn money toward college expenses by working on campus.

Scholarship awards are based on the organization’s criteria or group that is providing the funds set.

Students who are offered and accept student loans through the University will be able to track their total amount of debt and complete the counseling for the loans through studentloans.gov.

Students receiving student loans or the TEACH grant must complete entrance counseling, usually required upon the first time receiving the loan. Then students have to complete financial awareness counseling, usually around the second or third year, and upon graduation students have to complete exit counseling.

Lawrence suggests, “If students are able to consolidate their loans, they should read the fine print and make sure they are choosing a company with low fees and the lowest interest rate possible. Keep the amount of debt low as possible, keep it manageable and pay it off in a timely manner.”

Growing Concern

Scholarships, grants, and loans become the focus as student debt grows

Pauline Wilson

•

April 11, 2013

0

More to Discover